MSME stands for Micro, Small and Medium Enterprise. The Government of India introduced the concept of MSME in agreement with MSMED (Micro, Small and Medium Enterprises Development) Act, 2006.

The MSME sector contributes vastly to India’s socio-economic development and is an important sector of the Indian economy. Contributing to nearly 35% of the country’s GDP, around 40% of the country’s exports and 45% of the manufacturing output, it is right to refer to MSMEs as the ‘backbone of the country.’

As per the reports, there are currently around 63 Million (Source : www.ibef.org/) registered MSMEs in India and one can expect equal or more numbers of unregistered as well. Until June 21st units involved in the Manufacturing and Service industry qualified as MSMEs and the Ministry has recently decided to include the Retail and Wholesale sectors also under the ambit of MSMEs.

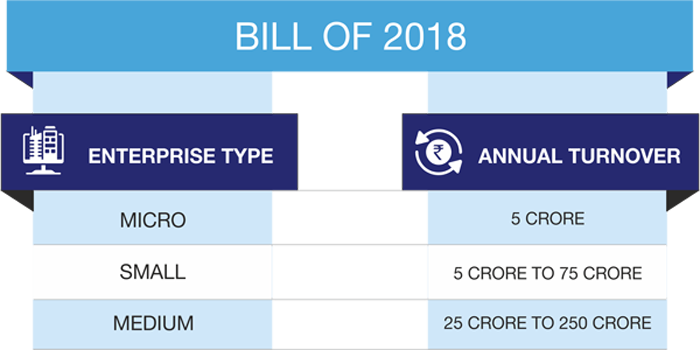

The below table shows bill of 2018 for MSMEs based on their annual turnover.

Getting a loan is difficult for most MSMEs

Most MSMEs face endless problems of accessing finance or availing of an MSME loan. Although the government has implemented appropriate measures for businesses, the regulatory loopholes and the current opaque system hamper the prospects of MSMEs. Most MSME owners, due to lack of knowledge, are unaware of the various products available to avail loan.

Businesses face issues related to the timely purchase of materials, paying the employees, access to new technologies or increase manpower due to lack of funding. Most MSMEs don’t get the right type of funding, pricing, products/schemes at the right time.

Despite these challenges, success in getting the finance and business right is not difficult to achieve if you find the right source like aagey.com to support your funding needs.

SIDBI (Small Industries Development Bank of India) being the nodal agency acts as the Principal Financial Institution for promotion, financing and development of the MSME sector, and aagey.com is all set to get associated with SIDBI soon.

Benefits of owning an MSME

If you own a Micro, Small or Medium enterprise and haven’t registered your MSME yet, you should know that on registering your MSME via Udyam Registration (formerly known as Udyog Aadhar), you will be liable to enjoy many benefits. It helps in getting government tenders, the interest rate on bank loans becomes lesser, becomes easy to get approvals, licenses and many more benefits.

To aid the MSMEs, the Finance Ministry unveiled a scheme called ECLGS (Emergency Credit Line Guarantee Scheme). ECLGS aims at funding up to Rs. 4.5 lakh crore to MSMEs given the economic distress caused by the COVID-19 pandemic with sovereign guarantee. MSMEs can avail up to 40% of their 29th February 2020 utilization as an additional facility under the ECGLS schemes ( www.eclgs.com ). MSME Minister has said that the government is committed to uplift MSME sector in India and is taking several steps to improve the contribution of MSME’s industries to the economy. He also said that the overall contribution of the MSME sector in the economy will be increased to 40% from the present level of 30% in the coming years.

Why aagey.com?

aagey.com provides MSMEs with exposure to all the loan options available in the market. It is a single platform, where MSMEs are exposed to more than 1000 different secured and unsecured products.

aagey.com understands the requirement, captures around 8000+ data points and runs them through an automated credit assessment engine, which uses the latest technologies like Artificial Intelligence and Machine Learning, to evaluate the proposal across the 1000 products with more than 3,00,000 probabilities. The MSME is then given a list of products that would best suit the requirement.

aagey.com has disbursed around 1500 Crore, serviced over 7000 deals, have an MSME base of 2 Lakh and have assessed 25000 of them.

Did you know – 100Cr of these disbursements have been in Multiple Foreign Currencies in the form of Foreign Currency Term Loan / Over Draft limits at Libor (https://en.wikipedia.org/wiki/Libor) linked rates

aagey.com ensures:

- Authenticity

- Faster Decisioning

- Transparency

- Last Mile Connect

- Ethics

- Flexibility

aagey.com doesn’t just stop at recommending the right product. It also ensures that the fund reaches your account with zero hassles. Get your MSME loans right away with a faster processing cycle, reduced interest rates and no collateral with the help of aagey.com!

Leave a Reply

You must be logged in to post a comment.